We know that becoming more sustainable is the right thing to do by our planet. But it can also be the right thing to do by your business. And with our suite of sustainable finance products and our dedicated teams of relationship managers to support, HSBC can help get your business there.

Building Sustainable Business in Australia with HSBC

Back to Sustainable Banking for Business in AustraliaProducts and Solutions

We are committed to supporting our 1.5 million clients all over the world to make the transition toward net zero. The path to net zero will look different for different customers and industries. From renewable energy to supply chains, we have the dedicated knowledge and suite of sustainable products to help you achieve your environmental and business ambitions.

Loans

Sustainability Linked Loans (SLL)

SLL are made available to facilitate and support environmentally and socially sustainable economic activities and growth. They incorporate ESG criteria into financing, and provide a way for corporates to demonstrate the implementation of their Corporate Social Responsibility strategy through specific targets and progress tracking.

Sustainability Linked Loans provide an incentive to deliver on your sustainability plans by linking the interest rate on the loan to the achievement of your company’s sustainability performance targets.

Green Loans

Green Loans are made available for the finance or refinance, in whole or in part, of new or existing eligible Green Projects. Green Loans are similar to a normal corporate loan, but follow the Green Loan Principles (GLPs), which were launched by the Loan Market Association in March 2018.

Bonds

Green, social and sustainability (GSS) bonds

With an increased focus on a transition to a sustainable global economy, sovereigns, corporates and financials have increasingly looked at raising sustainable financing through the bond market. There are three main categories of Sustainable Financing bonds: Green bonds, social bonds and sustainable bonds with the classification being linked to the use of proceeds and structure in line with the relevant ICMA Bond Principles.

Sustainability-Linked Bonds

Sustainability-linked bonds align to the Sustainability-Linked Bond Principles established by ICMA. The financial and/or structural characteristics can vary depending on whether the issuer achieves predefined sustainability or ESG characteristics. Entities that issue SLBs can set key performance indicators (KPIs) which are aligned with their sustainability strategies. It allows the issuer more flexibility to set more general sustainability goals, rather than being tied to financing specific projects like solar power plants or green buildings.

Transition Finance

Transition finance means any form of financial support that helps high-carbon companies start to implement long-term changes to become greener. It bridges the gap between traditional and sustainable financing as businesses begin the journey to net zero.

HSBC co-chaired the International Capital Markets Association (ICMA) working group that developed the Climate Transition Finance Guidelines. The new guidelines act as additional guidance for issuers seeking to utilise green bonds, sustainability bonds or sustainability-linked bonds towards the achievement of their climate transition strategy.

Sustainable Supply Chain Finance

Take advantage of tailored banking services to support sustainability goals for buyers and suppliers by leveraging the power of our network. As a leading international bank, we play a unique role in supporting a shift to sustainability in global supply chains. HSBC is embedding sustainability into the products and services we offer to customers, with the aim of supporting enhanced sustainability in our customers’ supply chains.

Green Trade Financing

Designed to support the working capital requirements of our clients that fulfil the Green Loan Principles and measurably contribute towards an ESG agenda. Our solutions are inclusive of Trade Loans, Guarantees, Receivable Finance, Export & Imports, Commodity Structured Trade Finance and distribution.

Trade Sustainable Instruments

Take advantage of tailored banking services to achieve sustainability goals for buyers and suppliers by leveraging the power of our network.

HSBC offers a sustainable label for guarantees, Documentary Credits, or standby letters of credit issued under a sustainable trade facility to exclusively facilitate environmentally and/or sustainable economic activities.

Sustainable Supply Chain Finance

HSBC offers a sustainable supply chain finance solution, which addresses customers’ working capital needs through a tiered pricing solution based on the company’s methodology for measuring the sustainability performance of its suppliers.

Find out more

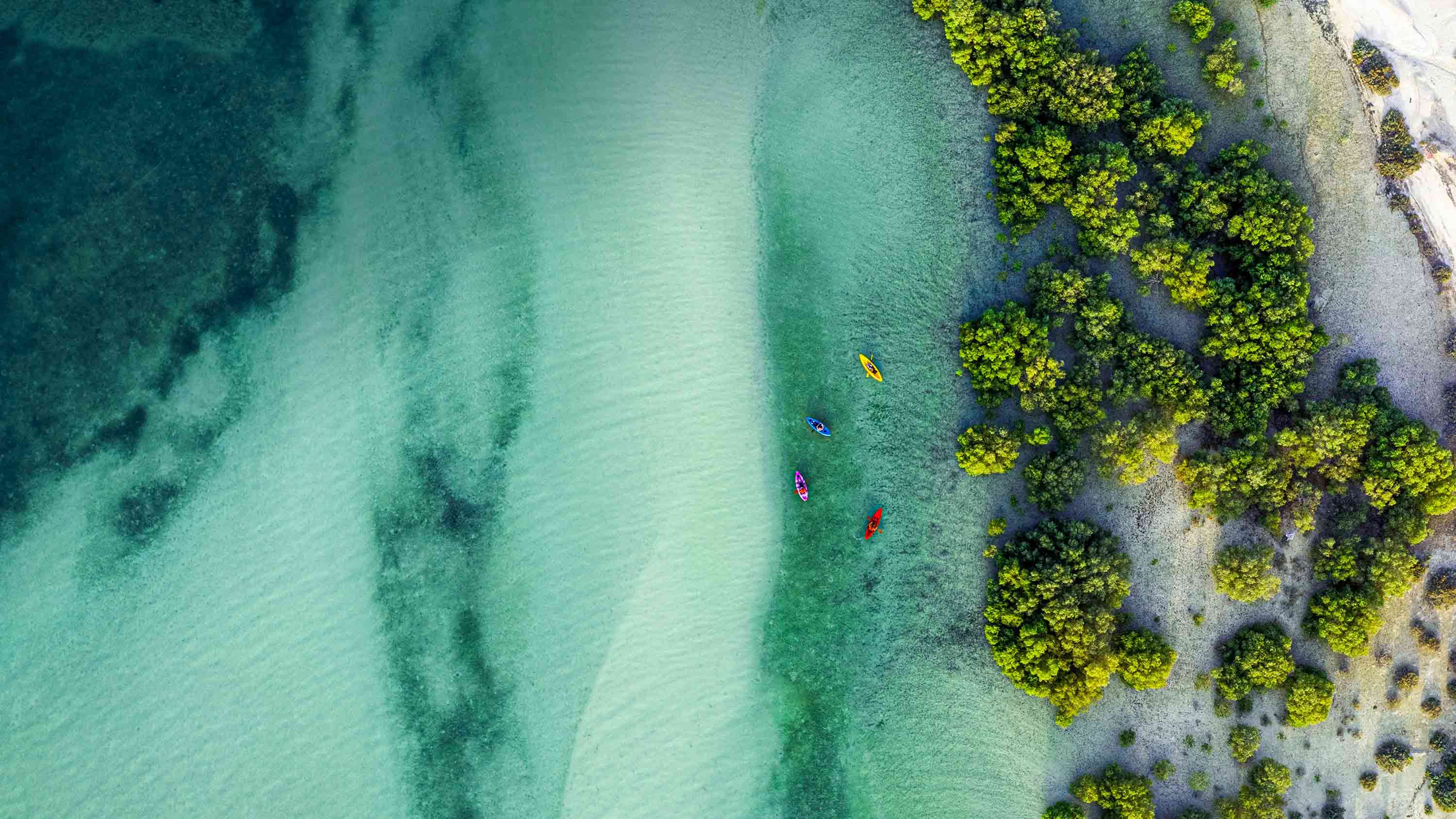

A sustainable approach to business

Sustainability is about safeguarding the long-term health of the environment and ensuring a thriving, resilient future for your business and wider society.

Inspiration from our clients

Discover how Australian businesses are embracing sustainability.

Insights

Whatever your business sustainability principles and goals might be, access the latest thought leadership content and practical advice to help you prepare for a greener future.