- Article

- Sustainability

- General Sustainability

Stepping up: Why more Australian companies are embracing ESG

A strong sustainability story is increasingly important for companies seeking to access capital and reduce risk.

Environmental, social and governance (ESG) issues are becoming more mainstream. As businesses realise how getting their ESG proposition right can create value and improve resilience, many are building up their sustainability credentials.

But more needs to be done. About 38 per cent of investors who responded to HSBC’s first global ESG sentiment survey believe businesses pursue sustainability mainly for public perception. Only 14 per cent feel that it’s out of genuine concern.

At HSBC, we know how important it is for Australian companies to strengthen their ESG practices and reduce their risk exposure. Watch this video to find out more.

Growing need to decarbonise and adapt

Acting on ESG issues has become more pressing as climate risks and impacts grow. However, climate adaptation remains inadequate, according to Wai Shin Chan, who is HSBC’s Global Head of ESG Research. Citing a recent report by the Intergovernmental Panel on Climate Change, he says all sectors need to decarbonise and that businesses must also pay attention to methane as one of the world’s fastest growing greenhouse gases.

Don’t assume that cutting emissions is someone else’s problem. There’s a lot of pressure throughout the supply chain to do that no matter the size of a company.

|

Deeper awareness of where a company can decarbonise and adapt is vital. “I always like to emphasise adaptation and how we can embed resilience in our businesses and supply chains. Now, why is supply chain so important? Because these days, all companies are part of a supply chain,” Chan argues, adding that some climate risks have cascading impacts on infrastructure and supply chains in Australia.

“There’s also been a bigger emphasis not just on moving away from fossil fuels to renewables or from internal combustion engines to electric vehicles, but also on going to the next level down, like [cutting] Scope 3 emissions.”

Building resilience has more benefits than costs

The good news is that the economic benefits of building climate resilience often far outweigh the related costs.

If a company has robust ESG practices, it shows in its performance and can underpin its share price, says Chan. Lending institutions also give preferential treatment to companies with strong sustainability performance because they see them as lower risk.

In fact, capital is shifting away from companies or issuers without a credible sustainability story, according to Jonathan Drew, Managing Director for ESG Solutions at HSBC Global Banking.

If a borrower can show that their emissions pathway for their activities aligns with lending institutions’ pathways broadly, it becomes much easier for the bank to lend to that borrower.

|

“Institutions with more than US$130 trillion in assets under management are signing up for the Glasgow Financial Alliance for Net Zero. Companies need to be thinking about positioning requests for capital from those institutions against the objectives they’re setting [in the alliance],” adds Drew.

“However, companies have to think very carefully about what makes sense for them as issuers, whether they’re going to use labelled formats, such as sustainability-linked loans.”

Showing commitment through sustainable finance

The past few years have seen more companies adopt sustainability-linked loans to manage their ESG risks. By marrying their sustainability performance with this form of financing, businesses are demonstrating their commitment to sustainability.

There’s an increasing trend in green and sustainability-linked loan volumes broadly, but the highlight for me is the exponential growth of the sustainability-linked format in the last 18 months.

|

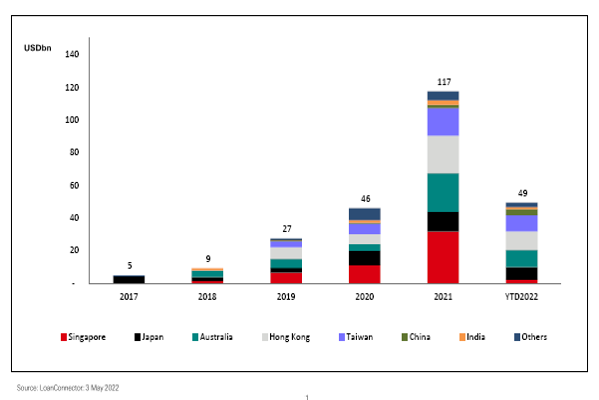

“We’ve seen phenomenal growth in Australia, and it’s actually become one of the leading markets in Asia,” she adds. The global volume of green and sustainability-linked loans soared from US$258 billion in 2020 to US$721 billion in 2021.

Australian issuers contribute significant ESG loan volumes in Asia Pacific

“From a borrower’s perspective, having the ability to bake into the financing transaction a monetised reward through a reduction in loan margin for achieving a sustainability target, that clearly has appeal in the financial sense,” says Drew.

“The other big driver of sustainability-linked [loans] is you don’t have to have an explicit linkage [of the funds] to an underlying project. So, this has taken the product to be applicable across a wider range of sectors, where there may not be so readily definable green assets.”

Getting buy-in is important

Chan suggests that those embarking on the ESG journey start by identifying material issues in their business.

“The journey is about being aware of what the issues are and how they affect your business activities, then seeing over what time horizon those issues will make a difference to your business, what changes can be made and whether you need to raise sustainable finance to meet those changes,” he says.

Drew agrees. He adds that one effective approach is to get the different parts of the business to work collectively.

“It’s about teams that break through the silos and address ESG across the whole business. The companies that do that successfully are companies that come out as winners in terms of financing.”

Opening up a world of opportunity for the planet

Discover how HSBC can help you make the transition to a more sustainable business.