The transition to net zero is generating new jobs, stimulating new industries and generating new opportunities for growth. HSBC Australia can help your business be part of it and continue to prosper.

Need help?

Find out how we can support your transition to net zero

Can an opportunity for the planet, also be an opportunity for your business?

How we support our clients

Explore how our global and domestic clients are acting on their sustainability ambitions - driving impact for their business, employees and communities.

How is Cory Group turning waste into energy in the UK’s capital?

Supplementing sustainability for a healthy planet

Ramsay Health Care – making a difference with sustainable finance

Our sustainability solutions

HSBC’s sustainable finance and investment offering could help your business meet its ESG goals with a suite of solutions, expertise and tools.

Find out more below.

Our climate strategy

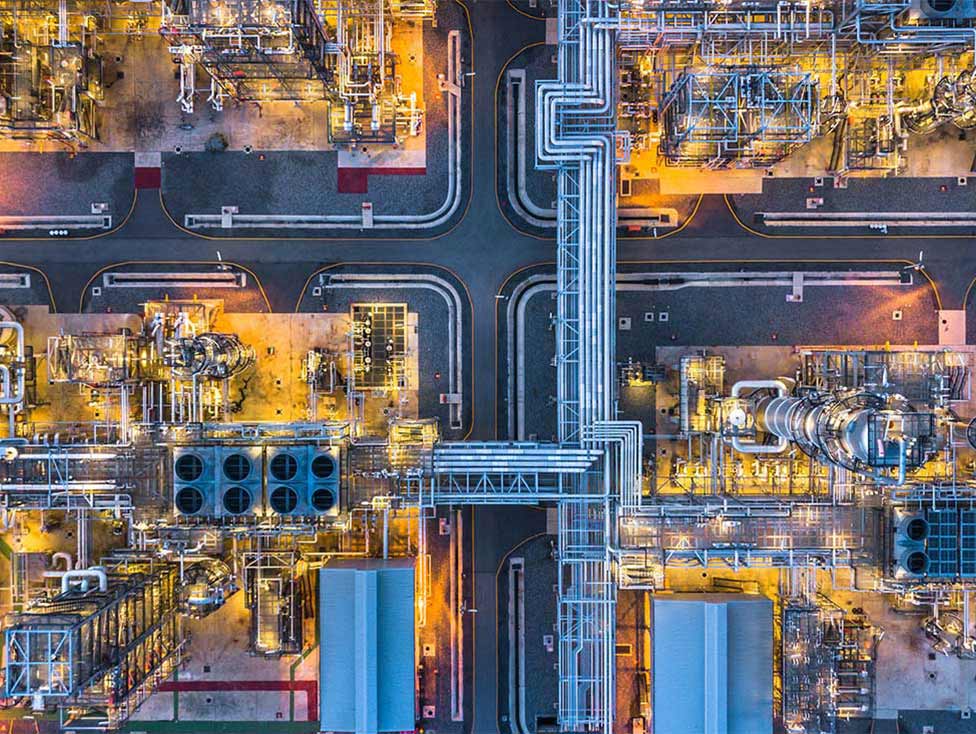

Today we finance a number of industries that significantly contribute to greenhouse gas emissions. We have a strategy to help our customers to reduce their emissions and to reduce our own.

Why partner with HSBC?

HSBC has been at the forefront of helping businesses and communities build a thriving, resilient future while opening up new opportunities for growth.

Award Winning

HSBC has been recognised by independent research agencies as being a market leader in sustainability:

- HSBC named 'Best Bank for Sustainable Finance' in Asia for the sixth consecutive year in the 2023 Euromoney Awards.

- HSBC recognised as the leading international bank for ESG / Sustainable Finance in the 2023 Peter Lee Associates Survey.

Pioneering market-leading transactions with Australian businesses

We have delivered a range of landmark sustainability solutions for our clients to support them in transitioning to net-zero including:

- 1st international Green Bond for an Australian corporate in 2014

- 1st Green Loan for an Australian corporate

- 1st public Sustainability Linked Bond for an Australian corporate.

Global perspectives, local support

We leverage our extensive global network and coverage across 64 countries and terrioties, and local on the ground teams, to help clients transition to more renewable and sustainable practices.

Start the conversation today